How to Build a Holistic Financial Well-Being Program for a Diverse Workforce

“Employers are realizing that the main source of [employee] stress is coming from finances, and it impacts other areas of well-being. It’s impacting people’s emotional and mental well-being, their work-life balance, and their physical well-being,” said LaTonia McGinnis, assistant VP of health transformation at management consulting firm Aon.

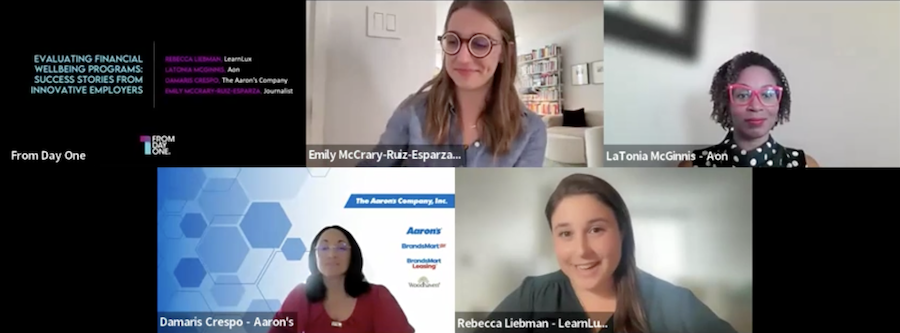

McGinnis was part of a From Day One webinar about how innovative employers are offering financial well-being tools to their workforces. She and her fellow panelists discussed why financial wellness benefits are such an important part of employee care and how companies can identify and meet the financial needs of their workers.

Rebecca Liebman is the CEO and co-founder of financial well-being platform LearnLux. She says the company has seen in its clients a renewed sense of responsibility. “Companies are wanting to step up and be that support because so many people’s financial lives are tied to their company: their benefits, health care, retirement, insurance–it’s all through their employer, and now their financial health can be as well.”

Last year, CNBC’s financial confidence survey found that 70% of Americans were stressed about their finances, and more than half (52%) say their stress is worse now than before Covid arrived in 2020. The rate of inflation, increasing interest rates, and lack of savings were among the most commonly cited reasons for financial anxiety.

Holistic Financial Well-Being

Lease-to-own retailer The Aaron’s Company recently reevaluated its financial well-being offerings. It had a program in place, but Demaris Crespo, the company’s senior benefits analyst decided it was time to take inventory of employee needs and consider whether the program was the best fit. They found they had outgrown their old platform and needed something that encompassed a variety of financial tools, plus coaching and guidance from human experts too.

“Our workforce is very diverse, and we wanted to have a holistic approach to well-being and find different providers that will support us in that quest of bringing well-being programs to our employees,” she said.

One hurdle has simply been getting workers to pay attention to financial wellness benefits. Many just aren’t used to investing, planning, or trying financial coaching. Others are simply uncomfortable with the whole idea. “Talking about finances is never easy,” said Crespo. Aaron’s workforce is quite young, and few arrive with financial know-how. To get workers excited about what the company is offering, Crespo’s team is working with ERGs to get the word out, and so far, it’s been successful. “I think it’s important to put all these new tools and resources in front of the employees so they can see what’s out there and take advantage of it. That’s one of our main concerns, that sometimes you don’t know what you don’t know, so education is key.”

“There’s been so much shame about finance in our own culture, shaming people for what they have or haven’t done,” Liebman said. “Financial well-being has really been revamped over the last few years, and when you think about holistic financial well-being, it’s about meeting people where they are.”

Financial stress isn’t a problem only for low-income workers, PwC found. Over 40% of workers earning $100,000 or more report being financially stressed. The distraction of financial stress can affect sleep, mental health, and self-esteem.

Workers need more than just a 401(k) and an employer match, Liebman says. “That’s just one piece of your financial life. There are about 28 other decisions that people make as an adult that impact their financial life, from credit card debt to medical debt, student debt, emergency savings, raising their credit score, saving for college or having a 529 plan for a family member, all the way through to retirement drawdown and estate planning.”

How to Know What Your Workers Need

The panelists made it clear: Don’t assume you know what your workforce needs. “We typically ask a lot of questions and do a lot of discovery with our clients to determine what problems they’re trying to solve with their financial well-being program,” said McGinnis. “They tend to be laser-focused on one issue–it might be student loans or it might be early pay access–but then when we get into deeper discussions, we tend to determine that there truly is more of a need for holistic financial well-being.”

McGinnis recommends financial well-being vendors that blend technology with human guidance, providing access to certified financial planners (CFPs) that are required to act in the interest of the employees. She also recommends solutions that can serve the needs of a diverse workforce, usually with some level of personalization.

“Talk to your people, and listen to them,” said Crespo. “Conduct surveys, have meetings with your leadership team. And talk to your human resources. We have human resources agents in the field, and they take the pulse on what people need.”

Editor's note: From Day One thanks our partner, LearnLux, for sponsoring this webinar.

Emily McCrary-Ruiz-Esparza is a freelance journalist and From Day One contributing editor who writes about work, the job market, and women’s experiences in the workplace. Her work has appeared in the Economist, the BBC, The Washington Post, Quartz, Fast Company, and Digiday’s Worklife.

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.