Elevating Your Social-Impact Reporting to Meet Stakeholder Expectations

It’s not enough for companies to invest in social impact–they need to be accountable for it too. In a survey of corporate leaders, 80% said they plan on investing more resources into social impact collection and reporting compared to last year; what’s more, a similar percentage said that their companies place a lot of importance on doing such reporting. Therefore, it’s not hard to see how “Corporate Social Responsibility” and “Social Impact Reporting” have become corporate watchwords.

“If you are public, you have specific requirements,” said Brittany Hill, founder and CEO of the CSR partnership platform Accelerist. “Otherwise, they ask for more quantitative data: having a purpose-driven climate within a brand is mission-critical.”

Hill outlined Accelerist’s own method to streamline impact measurement, in order to focus on the fact that while collecting and curating social-impact data is a good place to start, what matters the most is reporting it efficiently, preferably through a data-driven approach that can help companies identify the issues that they stand for as brands, how to measure them consistently, how to vet appropriate organizations to build partnership with and invest funds in, and measure the impact being made.

Accelerist’s stance is in line with the contents of a Harvard Business Review article titled “A Reckoning Is Coming,” in which writers Michael O'Leary and Warren Valdmanis outline strategies to avoid social-impact reporting being merely a buzzword. These include public reporting on social and environmental impact with clearly defined criteria and metrics, holding companies accountable; and considering becoming public-benefit corporations, namely “a new breed of companies is explicitly balancing profit with a stated public benefit.”

The Importance of Definitions

In the first place, Hill reports that 80% of CSR executives want to invest more resources in initiatives related to environmental, social, and governance issues, or ESG. Environmental accountability focuses on sustainable products, renewable energies, and carbon emissions, which calls for sophistication “in tracking and measuring the activity and impact,” said Hill. As for governance, “over the last few years, we’ve seen how important governance can be. Companies in leadership and shareholders can be tuned in to that,” said Hill.

The social part of ESG, Hill said, is what Hill refers to as “The Wild West.” When we look at the workforce, she explained, we look at loyalty and job satisfaction. “There’s definite categories,” she continued. “What are we doing to support workers and their safety? Do we have paid family leave? Work-life balance? Unlimited PTO? Workplace training?” She suggests dividing social considerations into three main categories: workers, customers, and communities. Customers are, in fact, stakeholders, and communication and engagement with them is paramount. As for community, that involves job creation, human rights, community development, and community outreach.

That does present a series of market challenges. “If we have to greenlight more investments, technology, or people, there must be an impact tied back to financial health,” said Hill. Fortunately, that is entirely possible. In 2019, General Mills reported $4.8 million in savings and reduced its carbon footprint by 6,000 metric tons by implementing more than 60 energy-reduction projects. In terms of brand awareness, 92% of consumers say they would buy from a company with an excellent CSR program. When it comes to profitability, high-purpose brands are able to double their market value more than four times faster than low-purpose brands, while also creating higher levels of total shareholder returns.

Of course, There Are Challenges

Common challenges to reporting on CSR initiatives include not having enough worker capacity for it (43%), the absence of right tools (43%), no officially designated CSR team (35%), and no champion in leadership (31%)

“We want a 360-degree view in order to report in this way,” Hill said. “We, as the people doing the work, have to understand in a 360-degree view, what that CSR or ESG measurement is for our constituents for societal impact for brand and bottom-line impact, so widening your lens and widening our colleagues’ lenses to the impact of one department or metrics is really an important part of internal education, to bring all of those stakeholders together, so that you can report in that comprehensive way.”

Another crucial aspect is collaborative reporting for ESG. “We’ve heard from a lot of companies where you might have a philanthropic report that you’re publishing, you might have a sustainability report that you’re publishing over here, and they sit in two different areas: nobody sees it, and there’s no floating all boats effect.” Also, it’s unadvisable to focus on, say, 120 metrics. Hill suggests a more manageable number:

E: Sustainable products and services

S: Communication, charitable recipients and giving to community, workforce charitable engagement and workforce volunteerism

G: Diversity and opportunity policy, accountability to stakeholders, human-rights reporting, local-sourcing policy, board and gender diversity

Examples of Successful Combinations

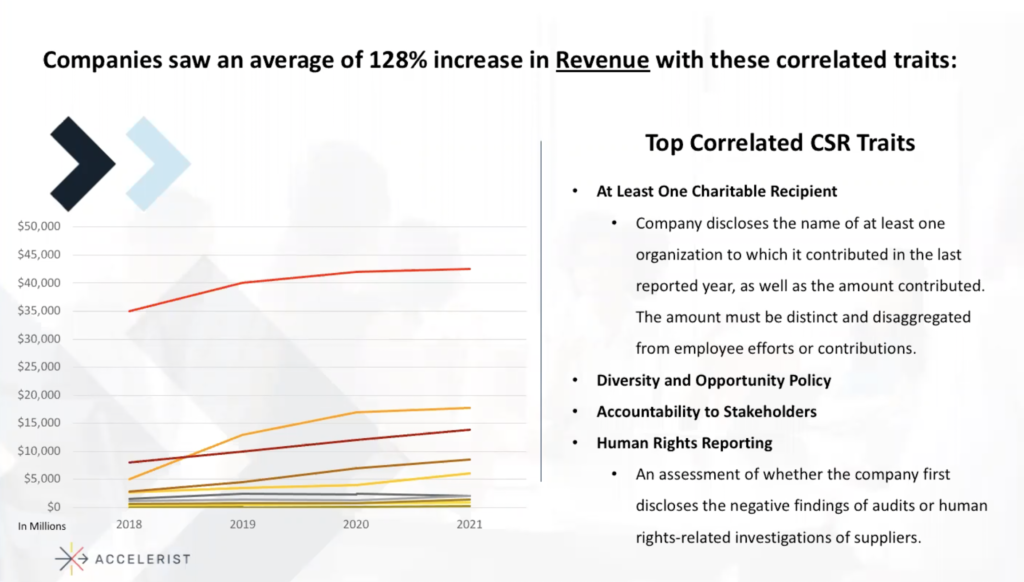

Companies did see a 128% growth in revenue with correlated CSR traits, including at least one charitable recipient, where the company disclosed the organization to which it contributed in the past year as well as the amount. This must be distinct and disaggregated from employee efforts and and contributions. The company also has to have a diversity and opportunity program, in which the company publicly discloses the policy meant to support it. Also, a company needs to have a local-sourcing policy, outlining whether the company discloses a policy, a commitment, and an effort to hire from the local talent pool. Gender diversity is also included in this, along with board-of-directors diversity.

Similarly, companies saw an average of 82% increase in profit margins with correlated CSR traits such as PTO for volunteering, a program to match employee giving (a program that discloses how to match employee donations and their giving preference), and accountability to stakeholders, in which the board of directors holds executives accountable to the interest of workers, customers, communities, and the environment.

Editor’s note: From Day One thanks our partner, Accelerist, or sponsoring this thought leadership spotlight.

Angelica Frey is a writer and a translator based in Milan and Boston.

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.