What Business Leaders Can Do to Improve DEI Efforts in the Face of Backlash

Can corporate America restore its momentum on diversity, equity, and inclusion? DEI initiatives became a must-have for business organizations in 2020, after the killing of George Floyd in May of that year sparked a new wave of civil-rights protest and discourse. That cultural conversation focused partly on workplace discrimination against Blacks and other marginalized people, and it led to countless leaders—some from the biggest groups in corporate America—stepping up with DEI plans to help close disparities in opportunities.

For a time, it seemed like those executives were delivering. According to Glassdoor data, DEI job openings grew 55% within a few weeks after the Floyd tragedy. Spending in the category surged, too. A November 2021 report from a top market research company said DEI funding was projected to reach $15.4 billion, more than double the amount it was in May 2020, by the year 2026.

While many leaders maintained the DEI programs they enacted within the past few years, a backlash against DEI quickly arrived. A survey of more than 800 HR professionals in various industries, conducted around six months after George Floyd’s death, found that about 80% of companies are “going through the motions” with DEI programming and not holding themselves accountable. Glassdoor research later revealed DEI programming growth stalled in 2022, and CNBC reported last January that, to some in underserved groups, many efforts geared toward tangible change have felt inauthentic. One source for the piece said the DEI programs they’ve interacted with feel more like “branding strategies.”

The turning tide against DEI picked up speed in June when the Supreme Court struck down affirmative action in higher education, a decision that many speculate will have an adverse effect on DEI efforts across industry. The New York Times reported that experts believe “the ruling will discourage corporations from putting in place ambitious diversity policies in hiring and promotion—or prompt them to rein in existing policies—by encouraging lawsuits under the existing legal standard.”

The same issues in place before 2020 persist for Black workers at the office. Gallup polling indicates that employees of color still report discrimination—and those who do also have a burnout rate that’s twice as high as workers who are not discriminated against.

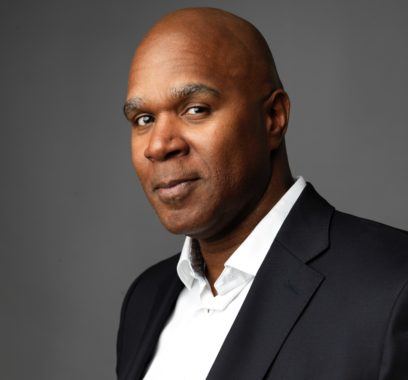

However, the high court decision and the failings of some organizations does not have to inspire total pessimism for those who are committed to furthering DEI’s progress. DEI strategist Amri B. Johnson, author of Reconstructing Inclusion: Making DEI Accessible, Actionable, and Sustainable, says this is an opportunity for the true advocates in the space to stand up. “We focus a lot on symptoms and we don’t focus enough on systems,” Johnson told From Day One. “Now we need to start building the systems” that will lead to improved, tangible DEI outcomes.

He adds that the Supreme Court decision and the pressures that it may put on companies to forego DEI investments could very well be used as an “excuse” to do just that. Eventually, though, “if a company uses that as an excuse not to be mindful, to cast [their] net wide and find people from different backgrounds to bring that insight, and create attention to [their] organization because people see things differently [due to] their embodied experiences, then they should stop” their DEI programs.

“If they want to miss out on talent, let them do it,” he says.

For those truly well-intentioned corporate leaders and people managers who want to carry on their DEI initiatives—not only because it’s the right thing to do, but also because it gives their businesses a well-chronicled leg up on the competition—here are some tips on how to ensure such programming can thrive, even in the face of DEI fatigue, and not come off like PR campaigns.

Add a “B” to “DEI,” for “Belonging”

Throwing money at the situation and writing declarative press releases is not going to solve problems like the ones that DEI programs are designed to address. Real people are affected by the culture that historically exclusionary business institutions have wrought, so it’s going to take person-to-person care and attention to disrupt the presence of outdated workplace management approaches.

Johnson says leaders must do “the little things” around the office—real or virtual—to ensure that workers feel a sense of belonging. “Thoughtful gestures can show someone that they are seen and welcomed in the group,” says Johnson. “Instead of sharing a funny story with just your closest coworker, invite the person within earshot into the conversation. When religious or cultural holidays roll around, don’t hesitate to say, ‘Ramadan Mubarak,’ ‘Happy Easter’ or ‘Happy Hanukkah’ to those who observe. The only kind of inclusion system that truly perpetuates belonging is one that centers on humanity, creating conditions for all people to thrive across their differences and similarities.”

Creating such a culture where behaviors like that are the norm may take a change in approach and mindset on the part of the leaders tasked with cultivating one. Julie Fink, VP of HR at the University of Phoenix, suggests that organizations think of “DEI” as “DEIB,” where the “B” represents “Belonging.”

“Belonging is how employees feel about their company, their boss, their leadership, their peers, whether their organization cares for them as individuals,” says Fink. “If employees feel they belong, they feel safe and more connected to the work and the organization.”

To help inspire this sense of security and connection, Fink says leaders should talk and listen to employees with a focus on “not only what they say, but what they don’t say in this area.” Ask: “Do they feel comfortable and safe to speak up in areas that can be improved, or bring forth suggestions or recommendations?”

When employees feel a sense of belonging at a job, as Harvard Business Review reported in 2019, they perform better, at a rate of 56%. They also take 75% fewer sick days and are 50% more likely to stay at their job, research showed.

Take a Skills-Based Approach to Hiring

Limiting recruitment hunts to individuals with gobs of experience and college degrees from top-level colleges is exactly how companies have stayed in a rut in which the same types of people are granted opportunities to achieve and advance. But considering skills required for a given position and just the general type of person who might be a great fit for your organization will render such histories of privilege irrelevant.

Amanda Hahn, chief marketing officer at HireVue, a talent recruitment and hiring platform, says a growing number of employers are “exploring alternatives to their traditional hiring habits,” with a mind toward better DEI outcomes. HireVue recently published a report covering global trends in hiring, which included surveys of more than 4,000 talent leaders and found that nearly half (48%) are adopting a skills-first approach to talent acquisition, “forgoing educational and past work experience unless they’re actually relevant to the job at hand,” Hahn said. “In doing so, they’re widening their overall talent pool, increasing the number of qualified candidates they attract and charting advancement paths for employees based on less-biased or fairer, objective data.”

And once interviews start—or maybe even earlier than that—prioritize the character of the candidates. Hiring teams should think about the culture of their organization and what kind of personality traits they’d like to find in the people they bring on board.

“When you hire someone, you hire the entire person, not just their output,” said Fink. “You cannot think that a person is just an employee, and worse yet, a commodity producing widgets. Every person is an individual and made up of a variety of elements and you need to ensure your policies, and more importantly your actual practices, speak to this.”

Advises Johnson, the author and DEI strategist: “Make sure you have designed your talent attraction and candidate experience to attract talent from and across a broad spectrum of identities and lived experiences. And, don’t stop there. Once you attract a diverse group of committed people, create paths for growth, development, and thriving to keep them. If you are unsure of how to do so, ask them.”

Hahn notes that greater integrations of technology can also help organizations expand the candidate pools each of them are accessing, while also providing hiring teams with greater insights into the types of individuals they might soon hire.

“There’s a misconception that technology is replacing human roles. Instead, it’s fulfilling mindless work, boosting employee productivity and allowing talent teams to focus on the most impactful parts of their job,” says Hahn. “Our report found that in the past year alone, two in three talent teams have implemented video or virtual interviews to boost hiring productivity. When asked what benefits talent teams saw from these changes in interviewing, respondents reported time savings, greater flexibility and a bigger pool of diverse talent.”

Don’t Base DEI Success Strictly on Numbers

The true impact of DEI can’t ever be completely quantified on a spreadsheet or in a PowerPoint. Sure, there’s the aforementioned impact a greater sense of belonging can have on the bottom line and other data on DEI return on investment, but measuring a culture—an atmosphere about the workplace—and levels of individual contentment is impossible.

DEI should ultimately be done because it’s good for people and their copmanies. “There are several areas where employers can make mistakes when beefing up their DEI programming,” says Fink. “The first is to think that DEI is just about the numbers and the typical race/ethnicity categories. Second is to tie bonuses or incentives to DEI metrics. This can drive compliance rather than commitment and possibly not the best decision for the business. We need to make the expected behavior clear, then reward or showcase that behavior. Set the example and shout it from the rooftops.”

Johnson says that limiting DEI focus to “single identities” is actually counterproductive to its mission. “Yes, it is very important to make the workplace welcoming for groups that historically have been pushed to the fringes—people of color, LGBTQIA+, the disabled, older employees, women,” said Johnson. “But true inclusion includes everyone, even those with longstanding power and privilege.”

Which is why people leaders should…

Avoid Playing the Blame Game

While changes to workplace culture and people management to enhance DEI of underserved people are needed, don’s create new discrimination in the process. Furthermore, excluding members of an employee base that may have benefitted from now-outdated systems does not align with the values associated with DEI initiatives in the first place.

“Be sure you are not making your DEI efforts feel divisive or punitive,” said Johnson. “Everyone in the organization needs to feel welcome to join in the discussion, but no one should feel singled out. Pointing fingers only perpetuates division. We need collective accountability without attempts to determine who is right.”

Accept Realities and Normalize Social Tensions

Practicing mindfulness and acknowledging grounded truths about the state of things might be the most crucial step of all if people leaders want their DEI programs to achieve desired outcomes while fostering a real sense of belonging for all members of an employee base. Thinking any initiative will be rolled out perfectly and solve all a company’s ills is a sure route to failure, DEI experts assert.

Johnson says DEI work will not remove social tensions—nor should it. Conversations that are open and honest will need to continue, and if they do, people will be bound to disagree or not reside on the same page with their colleagues. He adds that “tension is necessary” and not a bad thing in and of itself. “The danger comes when you don’t know how to navigate the tensions and complexities that come from those differences,” he said.

One way organizations can ameliorate tension around the subject of DEI is to actually calm expectations around the adoption of what Johnson calls “complicated jargon” that is inaccessible for many. Terms like “heteronormative,” “transphobia,” “BIPOC” and “unearned privilege” can be difficult for workers to understand and “may even raise employees’ defenses,” Johnson said.

“If you are speaking about DEI-related concepts and a term is introduced, explain the term, and make sense of it with the person or people you are engaged with,” he advised. “If you read a word that you are unfamiliar with, look it up, ask someone more familiar, and learn to explain it in a manner that is clear for you.”

Allowing people to be themselves, which includes displays of not only their strengths but also their blind spots, is the ultimate goal of DEI. Accept where voids in understanding lie, fill them up and move on—one step closer to greater harmony.

Michael Stahl is a New York City-based freelance journalist, writer, and editor. You can read more of his work at MichaelStahlWrites.com, follow him on Twitter @MichaelRStahl, and order his first book, the autobiography of Major League Baseball pitcher Bartolo Colón, at Abrams Books.

(Feature photo-illustration by Vadym Pastukh/iStock by Getty Images)

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.